New Insights on Rising Health Insurance Costs Revealed

Discover the latest findings on escalating health insurance costs and their impact on consumers and healthcare systems.

Introduction

The rising cost of health insurance is a pressing issue that affects millions of individuals, families, and businesses across the United States. Recent studies reveal that healthcare expenses continue to climb, with insurance premiums and claim sizes increasing at an alarming rate. For instance, ACKO reported an average rise of 11.35% in claim sizes in 2023, reflecting the growing financial burden on both insurers and policyholders.

For consumers, these rising costs translate into higher out-of-pocket expenses and reduced access to essential healthcare services. Healthcare professionals grapple with the challenge of delivering quality care amid financial constraints, while policy analysts seek sustainable solutions to curb the crisis.

This article delves into the latest insights on health insurance costs, exploring the factors driving this trend and its implications for different stakeholders. Whether you’re a consumer looking to navigate your insurance options or a professional seeking actionable solutions, this guide provides a comprehensive analysis tailored to your needs.

The Growing Burden of Health Insurance Costs

Current Trends in Healthcare Spending

Healthcare spending in the U.S. has reached unprecedented levels, with total expenditures surpassing $4.3 trillion in 2023. Insurance premiums have risen steadily, outpacing wage growth and inflation. For example, the average annual premium for employer-sponsored family health insurance now exceeds $22,000, placing a significant strain on household budgets.

Impact on Consumers

Rising health insurance costs have made healthcare increasingly unaffordable for many Americans. High deductibles, co-pays, and premiums force individuals to delay or forgo necessary medical care, exacerbating health disparities. A recent survey found that 45% of adults in the U.S. reported skipping treatment due to cost concerns, up from 33% in 2020.

(Source: Kaiser Family Foundation 2024)

Factors Driving the Increase in Health Insurance Costs

Rising Medical Expenses

The cost of medical services, prescription drugs, and advanced treatments continues to escalate. Hospital stays, for instance, now average $15,000 per admission, a 20% increase since 2019.

Administrative Costs and Fraud

Inefficiencies in healthcare administration and fraud contribute significantly to rising costs. It is estimated that administrative expenses account for 25% of total healthcare spending in the U.S., compared to just 12% in other developed countries.

Chronic Disease and Aging Population

The prevalence of chronic diseases, such as diabetes and heart disease, and the aging population drive up healthcare utilization and costs. By 2030, nearly 20% of the U.S. population will be aged 65 or older, further straining healthcare resources.

Innovative Solutions to Address Rising Costs

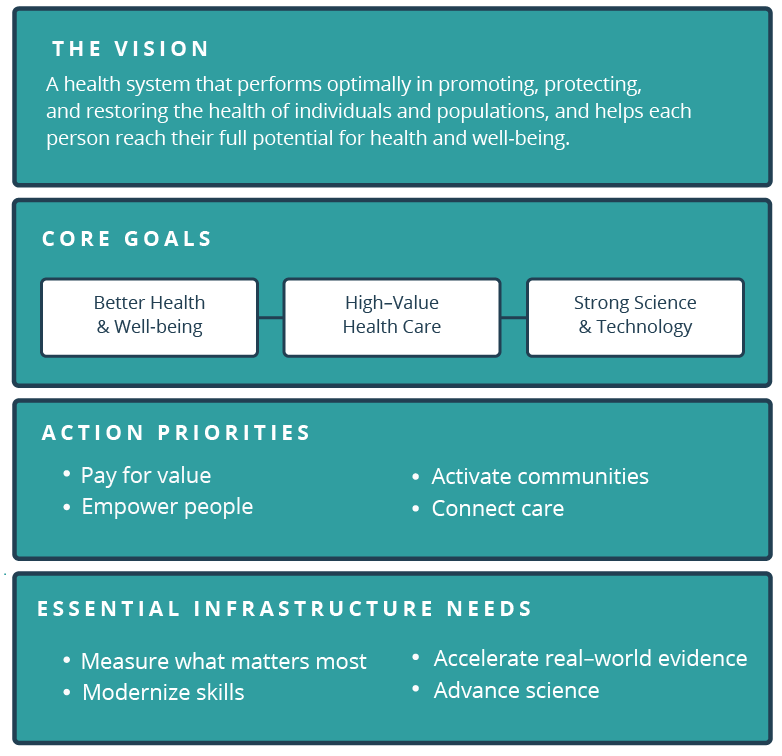

Value-Based Care Models

Value-based care focuses on improving patient outcomes while reducing costs. By incentivizing quality over quantity, this model has shown promise in lowering expenses and enhancing care delivery.

Telemedicine and Digital Health

Telemedicine has emerged as a cost-effective alternative to traditional in-person visits. During the COVID-19 pandemic, telehealth usage surged by 38%, demonstrating its potential to reduce overhead costs and improve access to care.

Employer-Driven Initiatives

Employers are reimagining health benefits to better support employees. Wellness programs, flexible spending accounts, and on-site clinics are among the strategies being implemented to curb costs and promote employee well-being.

(Source: Deloitte Healthcare Outlook 2024)

The Role of Policy and Legislation

Government Initiatives

Policy measures, such as the Affordable Care Act (ACA), aim to expand access to affordable health insurance. However, gaps in coverage and rising premiums highlight the need for further reforms.

State-Level Innovations

States are experimenting with cost-containment strategies, including price transparency laws and Medicaid expansion. These initiatives provide valuable insights into scalable solutions for reducing healthcare expenses.

Global Comparisons

The U.S. spends more on healthcare than any other country, yet lags in health outcomes. Learning from the cost-effective models of nations like Switzerland and Singapore could offer a roadmap for reform.

Case Studies: Real-World Examples of Cost Management

Employer Success Stories

Companies like IBM and Microsoft have implemented innovative health benefits programs, resulting in significant cost savings and improved employee satisfaction.

Government Programs in Action

Medicare Advantage plans, which combine traditional Medicare with private insurance, have demonstrated cost efficiencies while maintaining high-quality care.

Technology-Driven Solutions

Startups like Oscar Health leverage technology to streamline insurance processes, reducing administrative costs and enhancing the customer experience.

FAQ: Understanding Rising Health Insurance Costs

1. Why are health insurance costs increasing?

Health insurance costs are driven by rising medical expenses, administrative inefficiencies, and the growing prevalence of chronic diseases and aging populations.

2. How do rising costs impact consumers?

Consumers face higher premiums, deductibles, and out-of-pocket expenses, often leading to delayed or foregone medical care.

3. What are some strategies to reduce healthcare costs?

Value-based care, telemedicine, and employer-driven initiatives are effective strategies for managing and reducing healthcare expenses.

4. What role does policy play in addressing healthcare costs?

Government initiatives and state-level innovations aim to expand access to affordable care and encourage cost-effective practices.

5. How can technology help lower health insurance costs?

Technology, such as telemedicine and AI-driven administrative tools, can streamline processes, reduce overhead, and improve patient outcomes.

Conclusion

The rising cost of health insurance is a multifaceted challenge that demands innovative solutions and collaborative efforts. From value-based care models to policy reforms, there are numerous avenues to address this issue and ensure that healthcare remains accessible and affordable for all.

For consumers, staying informed about your insurance options and advocating for policy changes can make a significant difference. Healthcare professionals and policymakers must continue to explore sustainable strategies to curb costs while maintaining quality care.